Introduction

The balance sheet shows the overall financial health of a company at a given point in time. It is important for owners, lenders, and investors to assess a company’s current obligations and take advantage of opportunities using debt or raising additional equity from investors. The company’s balance sheet is essential for reporting to investors and creditors.

What is a Balance Sheet

The balance is one of the three core financial statements used to assess a company’s financial condition at a specific time. The other financial statements are the income statement and a cash flow statement. It summarizes a company’s assets, liabilities, and shareholders’ equity.

Assets are the items that the company owns. Liabilities are bills and debt that the company owes. Shareholder’s equity is the amount remaining, also called the company’s net worth.

A balance sheet is divided into two parts: total assets and total liabilities and equity on the other. The accounting equation, which states that total assets must equal the total liabilities and equity” Assets = Liabilities + Equity

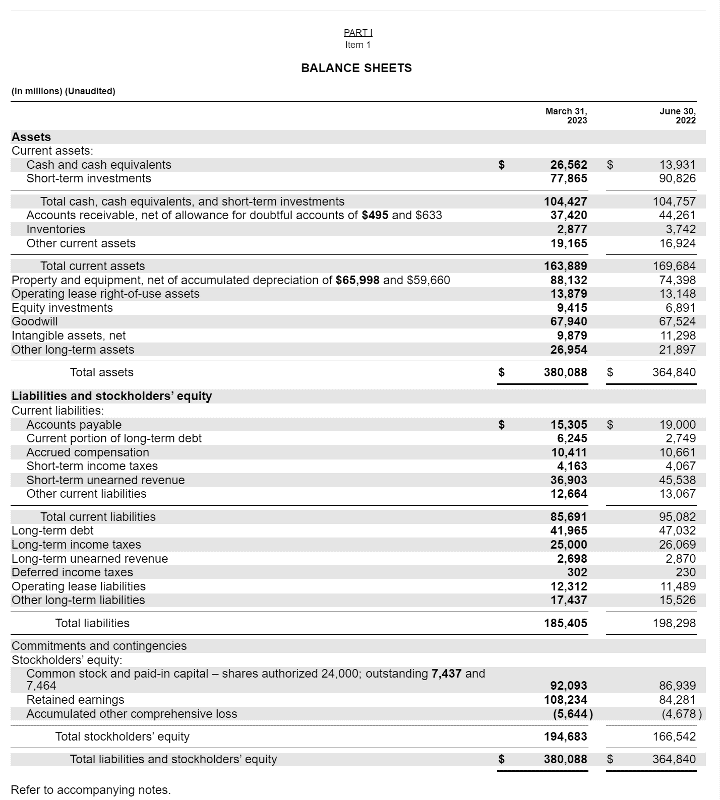

The balance sheet of Microsoft Corporation, as of March 31, 2023, will be used in the ratio analysis below.

Assets

The company’s assets are anything that has value and can be used to generate cash flow or revenue and repay liabilities. Assets are classified into two categories: current assets and non-current assets.

Your company’s current assets are assets you expect to be converted into cash or used up within one

year.

Current assets may include the following:

- Cash and cash equivalents: funds held physically or as a deposit at a bank.

- Cash equivalents: short-term investments with a maturity date of less than a month.

- Short-term investments: stocks and bonds ready to be converted into cash.

- Accounts receivable: the amounts owed to the company for services performed or goods sold but have not yet been paid. Typically an allowance is made for doubtful accounts that are severely overdue.

- Inventory: items available for sale and raw materials, including both partially made and finished goods.

- Prepaid expenses: expenditures that will expire within one year from the balance sheet date and represent a prepayment for an expense that has not yet happened. Examples of prepaid expenses include insurance, rent, interest, and taxes.

Non-current assets are long-term assets intended to be held for over one year. Non-current assets may include the following:

- Property, plant, and equipment or fixed assets: all buildings, machinery, and equipment.

- Long-term investments: stocks and bonds expected to be held for one year.

- Intangible assets: items like patents, copyrights, and trademarks.

Liabilities

The company’s liabilities are its obligations to its vendors and lenders. Just like assets, liabilities are separated into current and non-current liabilities.

- Current liabilities include the following:

- Accounts payable: unpaid funds due to vendors for services or goods purchased.

- The current portion of long-term liabilities: debt obligations that will be paid within a year. For example, payments will be made on a ten-year loan on fixed assets in the current year.

Non-current liabilities include:

- Deferred taxes: taxes that will be paid in the future due to the difference in accounting based on generally accepted accounting principles and tax law.

- Other long-term debt may include bonds payable, pension fund liability, and mortgages.

Equity

Also commonly known as “shareholder equity,” it reflects what remains after your company’s liabilities are subtracted from your company’s assets. Shareholder’s equity can also be increased by the sale of stock/ownership in the company and decreased by paying dividends to shareholders.

Accounts included in shareholder’s equity include:

- Common stock: money paid by shareholders to purchase ownership in the company. Common stock is assigned an arbitrary value when a company is created. This is called the “par value.”

- Additional paid-in capital: money paid above the par value of the common stock by investors.

- Retained earnings: the accumulated earnings of the company. Dividends to shareholders are paid from the surplus of retained earnings.

Each of these parts of the balance sheet plays a crucial role in understanding a company’s financial position. Assets provide insight into the company’s available resources, liabilities reveal the financial obligations the company must meet, and shareholder equity indicates the company’s net worth or what the shareholders would receive if all assets were liquidated and liabilities paid off.

Analyzing the Balance Sheet

Several measures can be used to analyze a company’s balance sheet. Some critical information that can be derived from a balance sheet is liquidity, solvency, and profitability. All numbers use in calculating the ratios are from Microsoft’s balance sheet above.

Liquidity Ratios

A liquidity ratio measures how easily a company can pay its short-term debts with its current assets. A high liquidity ratio means the company has enough cash or cash equivalents to meet its obligations.

Below are two of the most common liquidity ratios.

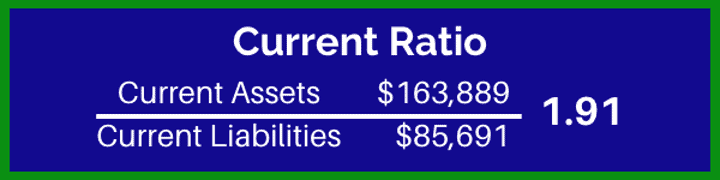

1. Current Ratio

The current ratio measures a company’s ability to pay off its short-term debt and bills using its current assets, such as cash, account receivables, and inventory. It’s calculated by dividing the existing current assets by the current liabilities. The current ratio between 1.5 and 3 is considered positive.

2. Quick Ratio

Also known as the acid-test ratio, the quick ratio is similar to the current ratio, except it excludes assets that cannot be converted to cash quickly. This would exclude inventory since it could only be sold in a few days with a steep discount. This ratio should always be above one.

Solvency Ratios

Solvency ratios gauge how well a company can meet its long-term debts with its total assets. A high solvency ratio means the company has enough assets to cover its liabilities and still has some left for future growth. Below are two examples of solvency ratios.

1. Debt-to-Equity Ratio

The debt-to-equity ratio provides insight into a company’s leverage by comparing its total liabilities to shareholder equity. It helps determine how much debt a company uses to finance its operations compared to using its resources. The debt-to-equity ratio should be under .60.

2. Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to meet its interest payments on outstanding debt. A higher ratio indicates greater financial comfort.

Profitability Ratios

Profitability ratios measure how much profit a company is making from its revenue. A high profitability ratio means the company earns more income than expenses and has a healthy margin. The following are two ways to calculate profitability.

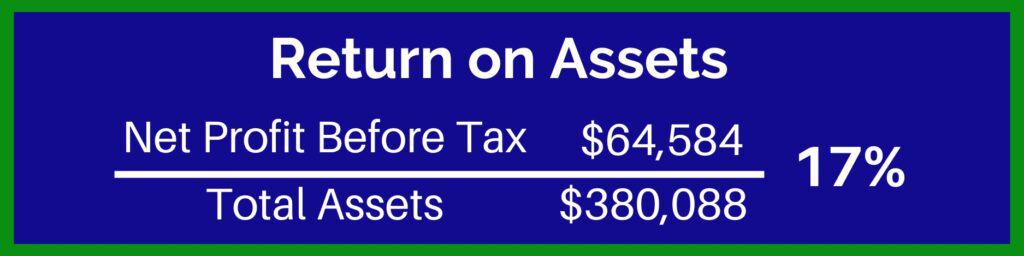

1. Return on Assets (ROA)

ROA measures the efficiency of a company using its assets to generate profits. It’s calculated as net income divided by total assets. An excellent ROA is a ratio above 20%, but it should not fall below 5%.

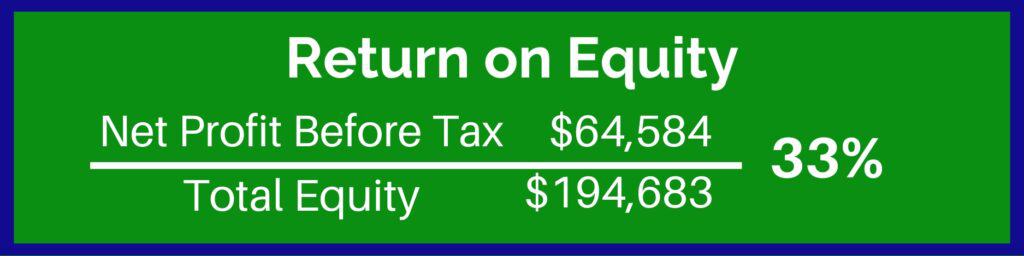

2. Return on Equity (ROE)

ROE measures how much profit is generated from money invested by shareholders. It’s calculated as net income divided by shareholders’ equity. A good ROE is between 15 to 20%. An ROE of over 40% is considered exceptional.

Tip: If you’re looking for some ways to increase your profitability, check out our “5 Ways to Increase Your Profitability” Blog Post

Importance of the Balance Sheet in Financial Decision Making

Assessing a Company’s Financial Health

As we can see from the ratios above, the balance sheet is an excellent tool for determining a company’s financial health. By understanding the company’s assets, liabilities, and shareholders’ equity, we can determine its net worth and provide insight into how easily it can convert assets into cash to pay off debts. This is why liquidity ratios are significant in evaluating a company’s health.

A company with high debt compared to its assets may be financially troubled. On the other hand, a business with a growing asset base and a reasonable debt is considered financially healthy, increasing the chance of borrowing additional money. The solvency and profitability ratios show these types of issues.

Beyond the ratios, comparing the balance sheet to see how a company performs over time is important. This is called trend analysis. By reviewing the increases and decreases in each section of the balance sheet, you can determine how a company uses its resources. An increase in assets would be a sign of growth. An increase in liabilities could indicate the company is struggling to generate revenue.

Attracting Investors and Lenders

By looking at the balance sheet, investors can see if the company is using its resources well and earning profits. Lenders can also use the balance sheet to check if the company can repay its debts on time. A balance sheet can help investors and lenders assess how much financial risk is related to the company.

For example, based on the interest cover ratio, we can determine that Microsoft can cover its interest payment from earnings 43 times. This shows lenders and investors that the company is more than capable of making interest payments.

Many times, lenders will require, as a part of debt covenants, a company to remain above specific ratios as a part of the term of any loans. Investors may require this also to guarantee an inevitable return on their equity.

Making Informed Business Decisions

Finally, the balance sheet is essential for a company’s owners or management in helping make better business decisions. It can assist when deciding to invest in new assets, such as equipment or real estate, based on the company’s cash situation and ability to borrow additional debt.

Reviewing current liabilities and equity can also help meet operations goals for expansion or generating additional revenue. The goals can be funded by raising more equity by selling stock or taking on additional debt. Therefore, a balance sheet is essential for management to ensure they meet the company’s goals and use resources wisely.

Conclusion

The balance sheet is an important financial statement for anyone with a stake in a company. It can help you make better decisions and achieve your financial goals. By learning how to read the balance sheet and calculate different financial ratios, you can better understand a company’s financial situation and growth potential.