Do you wish you had a crystal ball to see your business’ future? One that would show its expenses, opportunities, and income so that you could be prepared to successfully meet challenges and chances? While I haven’t yet found that kind of fortune-telling device, I can offer the next best thing: a cash flow statement.

So, what’s the deal with cash flow statements? Why and how are they critical guides for your business decisions? In this article, we’ll dig into their purpose, break down their parts, and understand how to calculate them. Also, we will discuss how to use certain ratios to determine the impact of cash on your business.

After reading this article, you will:

Understand that cash flow statements provide an overview of how cash flows in and out of your company and why this is so important. Specifically, you will…

- Know that a cash flow statement consists of three parts – operating, investing, and financing activities – which provide insight into the sources and uses of funds.

- Be able to analyze the cash flow statement for positive vs. negative flows & key ratios and integrate it with other financial statements to reveal any areas that need improvement.

Understanding Cash Flow Statements

A statement of cash flows is a financial statement that provides an overview of a company’s cash inflows and outflows. It helps businesses track the flow of their cash and flags any issues that could have a negative impact.

Let’s start with the basics of why a cash flow statement is important.

The Basics of Cash Flow Statements

A cash flow statement is a financial report outlining how cash moves in and out of a business over a certain period. The cash flow statement consists of three parts:

- operating activities

- investing activities

- financing activities

Breaking down your cash flow statement into different sections lets you see where your money is coming from and going. This helps you understand how money is generated and spent within your business.

Importance of Cash Flow Statements

A cash flow statement will help you understand your company’s value and how cash is used in your business. Lenders may also use this information to determine the amount and terms of loans or credit lines available to you.

While it might be tempting to focus on your profit and loss numbers, they are missing critical parts of your business’s financial picture that are filled in by your cash flow statement. So, if you ignore your business’s cash flow and focus only on profit and loss, you are more likely to make uninformed decisions and be at risk of bankruptcy.

Components of a Cash Flow Statement

The cash flow statement is made up of three parts: operating activities, investing activities, and financing activities. These three sections record all the transactions that happen within a business, even if they aren’t directly related to selling products or services. Breaking cash down into three sections allows a business to understand where its cash comes from and where it goes. Let’s look at each part of the cash flow statement.

Operating Activities

Operating activities include cash generated from selling products, goods, or services. This section shows the cash your business generates from its primary operations.

When net income is calculated using the accrual method of accounting, it will include many non-cash items. These non-cash transactions need to be added or subtracted from the net income to calculate the actual cash flow. These adjustments may include:

- Adding back depreciation and amortization.

- Subtracting any expense paid with stock.

- Adding or subtracting inventory changes.

- Adding or subtracting changes in accounts receivable.

- Adding or subtracting changes in accounts payable.

Investing Activities

Investing activities include the source and use of cash to purchase or sell assets such as equipment, real estate, land, and non-cash equivalents. Investing activities are also significant as they show your company’s working capital.

Analyzing investing activities can help evaluate if decisions on the purchase and sale of assets are handled properly. Also, this information will help you evaluate your business’s ability to fund future growth with the addition of revenue-generating assets.

Financing Activities

Financing activities reflect the cash flow resulting from debt and equity financing and the repayment of borrowed funds. This includes:

- The issuance or payment of debt.

- The issuance of equity for cash or the repurchase of equity from shareholders.

- Payment of dividends.

Understanding financing activities will help determine expansion plans, obtain or pay off debt, and the ability to raise funds from investors through the sale of equity.

Calculating Cash Flow: Direct vs. Indirect Method

The two methods of calculating the operating activities section of the cash flow statement are the direct and indirect methods. Each of these methods will have the same outcome but will be calculated in different ways. Let’s compare the direct and indirect methods for calculating cash flow.

The Direct Method

The direct method is based on the cash basis of accounting, which recognizes income when received and expenses when paid. This method only displays the sum of all the cash collected from sales and cash payments during the reporting period, providing a simple view of your company’s cash transactions.

While the direct method may be easier to understand, it can be labor-intensive and complex to prepare. The direct method is also less commonly used as it requires real-time tracking of all cash transactions.

The Indirect Method

The indirect method is based on the accrual basis of accounting. Under this method, revenue is recorded when it has been earned rather than when it is received, and expenses are recorded when incurred, not paid. By adjusting net income, the indirect method accurately reflects your company’s cash flows, accounting for timing differences between cash transactions and the recognition of revenues and expenses.

The indirect method is more commonly used because it is simpler to calculate as it is easier to identify the adjustments to net income from the company’s balance sheet. Larger companies prefer this method.

Analyzing Cash Flow Statements

Positive vs. Negative Cash Flow

A positive cash flow indicates that you have more cash flowing into your company than out for the month, suggesting that your business is in a strong financial position. Of course, the opposite could also be occurring: a negative cash flow means that you are losing cash during the accounting period, which may be a cause for concern.

A negative cash flow is typically viewed as unfavorable; however, things may not be all bad. If you are just starting your business or investing in new opportunities, you need to spend more money now to make profits later. Examples include purchasing new equipment or hiring additional employees. While it might look bad at first glance, a negative cash flow can be part of the plan for future success.

The key is to dig into what’s driving your cash flow situation. This will allow you to make decisions based on your specific business needs.

Key Cash Flow Ratios

Key cash flow ratios are used to assess a company’s capacity to generate cash and detect potential cash flow issues. Some important cash flow ratios include free cash flow and operating cash flow margin.

Free cash flow is a measure of a company’s financial performance that indicates the amount of cash available after all expenses have been paid. It is calculated by deducting capital expenditures from operating cash flow.

Operating cash flow margin is a measure of a company’s capacity to generate cash from its operations. It is determined by dividing the operating cash flow by the total revenue.

These ratios not only give insight into present performance; they also point toward future improvement possibilities.

Real-Life Cash Flow Statement Examples

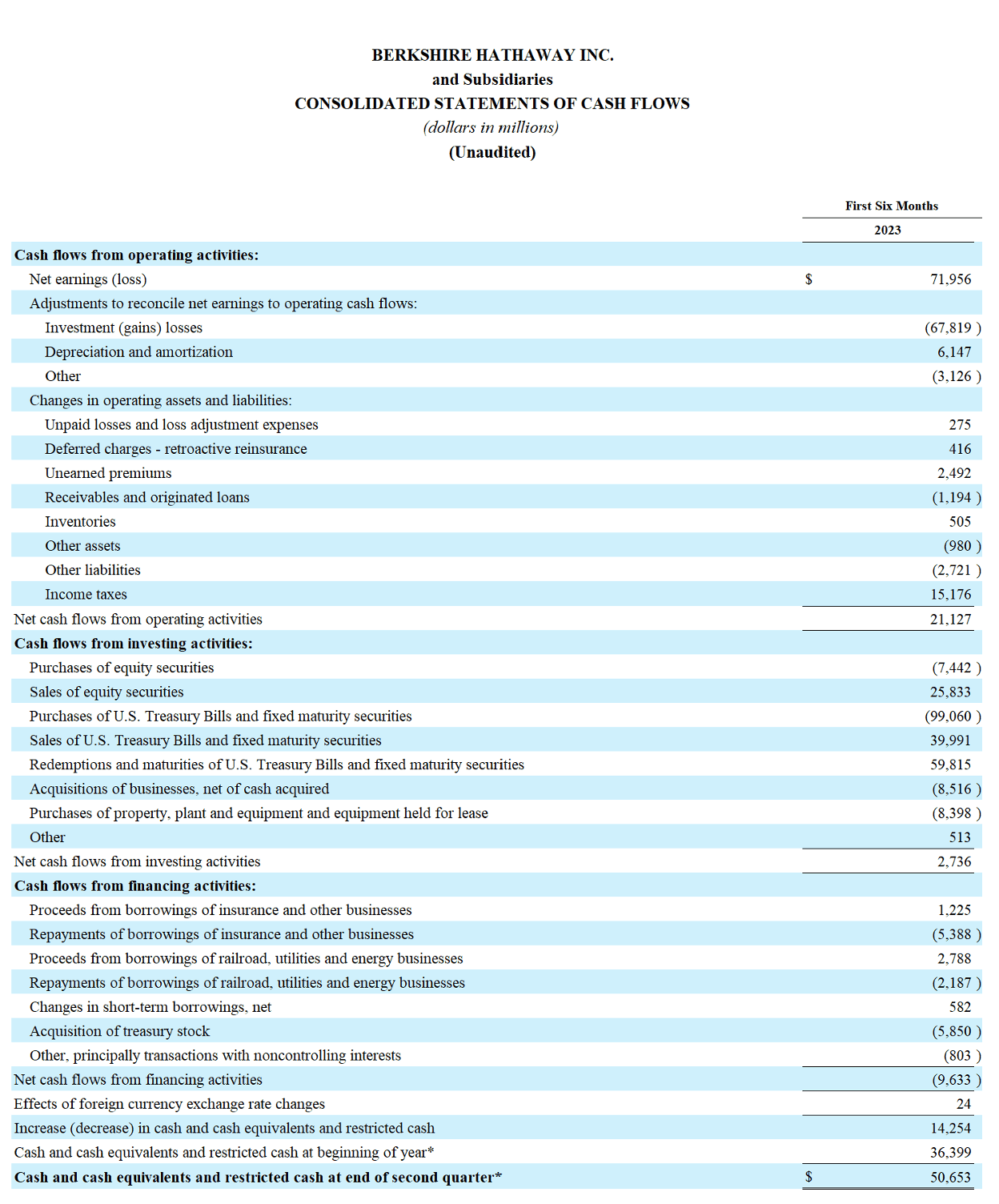

To see how this works, let’s analyze the cash flow statements of two actual companies that have different financial situations and cash flow trends.

Example Company 1: The Cash Machine

Berkshire Hathaway10-Q (sec.gov)

Berkshire Hathaway had a positive cash flow of $14 billion for the six months ended June 30, 2023. They generated $21 billion from operating activities. Obviously, the positive cash flow implies that Berkshire Hathaway is in strong financial standing, thus allowing Warren Buffet to keep his eye out for acquisitions and new opportunities.

Example Company 2: The Hot Mess

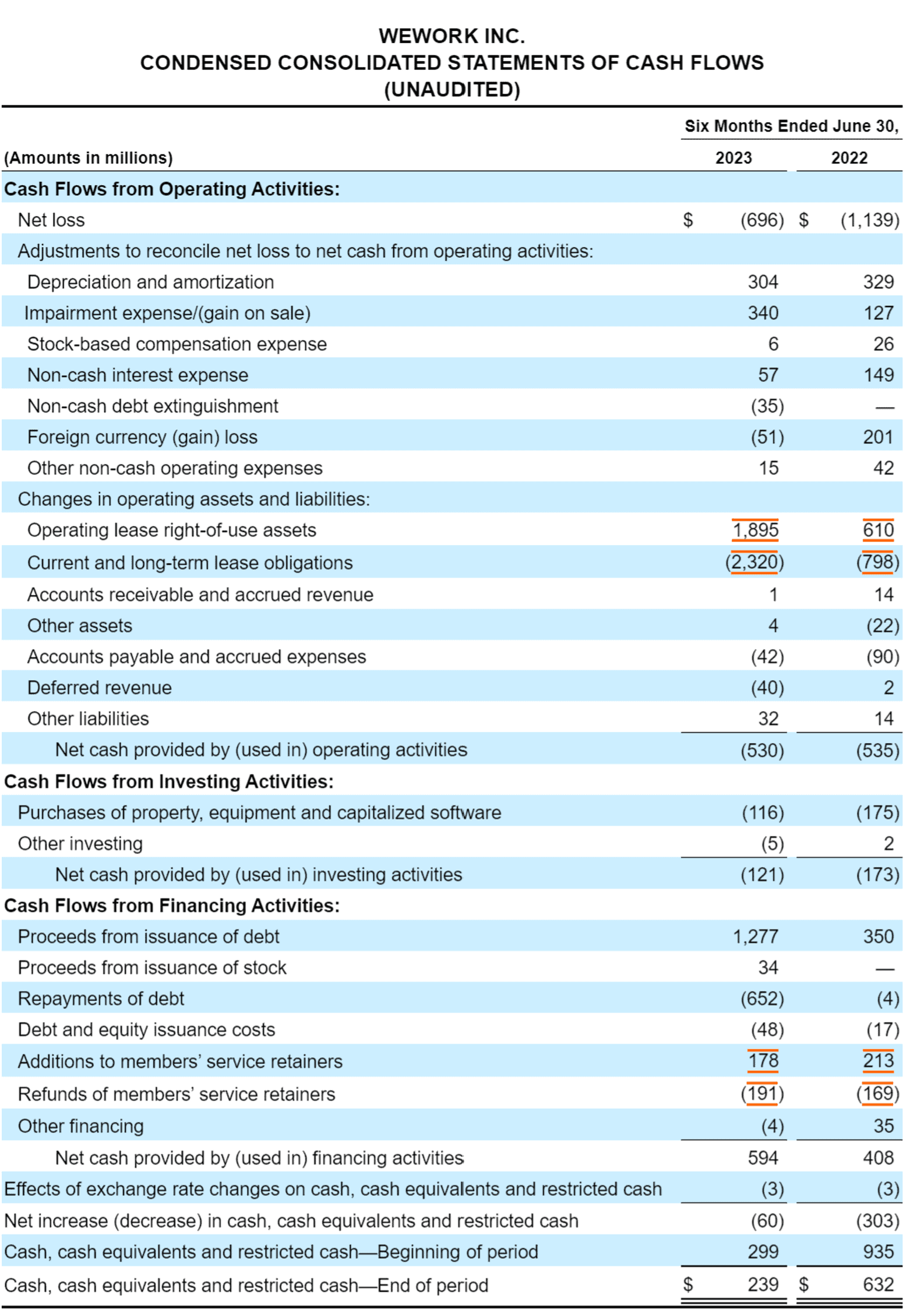

On the other hand, WeWork lost $60 million for the six months ended June 30, 2023. They used $50 million on operating activities. They borrowed a net of $625 million ($1.277 billion borrowed, less $652 million repaid) to continue funding the company. The company spent more cash than it generated, which may have been due to low profit margins (per the income statement, the gross profit margin was 14%) and over-investing in capacity.

Assuming an average burn rate of $88 million per month, this cash flow statement shows that WeWork only has two months of cash available to fund its operations. Management will need to address these cash flow difficulties to avoid bankruptcy.

Integrating Cash Flow Statements with Other Financial Statements

While cash flow statements offer an excellent overview of financial health on their own, their worth grows significantly when used in conjunction with income statements and balance sheets. Analyzing them together will take assessing your overall financial position and making informed decisions to the next level.

Let’s see how these financial documents – cash flow statements, income statements, and balance sheets – all work together.

Linking Cash Flow to the Income Statement

The income and cash flow statements are distinct financial statements that provide different perspectives on a company’s financial performance. The income statement displays the revenues, expenses, and net income or loss for a particular period, while the cash flow statement shows the flow of cash in and out of the company during the same period.

Analyzing both statements together paints an unfiltered view of your business’s financial standing. It can uncover potential problem areas or hidden opportunities for growth. Also, you can make decisions with more confidence because they’re backed by hard data rather than just gut feelings.

Connecting Cash Flow to the Balance Sheet

Looking at the balance sheet and cash flow statement together is also crucial. The balance sheet lists your assets, liabilities, and equity at a specific time. On the other hand, the cash flow statement tracks the ins and outs of cash over a specific period, showing how your company generates and uses cash.

By examining the cash flow statement and the balance sheet together, you can see your company’s overall financial position and determine how effectively you manage your cash. This comprehensive analysis can help you identify potential areas for improvement and make better-informed decisions about your company’s financial future.

Summary

Now that you understand the direct and indirect methods of figuring out your business’s cash flow, as well as how to interpret the resulting information and use it in connection with your income statements and balance sheets, you are equipped to find and tackle issues as they occur in and around your business. Your knowledge will help you better understand your company’s well-being and make more informed business choices.

Even though the cash flow statement isn’t a crystal ball, it will help you understand the financial details you need to make smart cash flow decisions. It’s a great tool to help you successfully move your business into the future.